PNB Rakshak Plus Scheme Assistance: PSU bank provides 17 crore; other important developments to look at

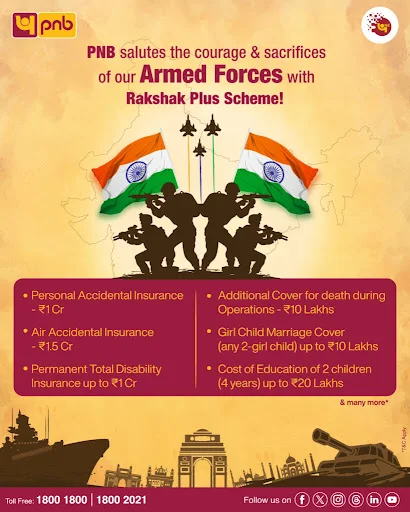

PNB Rakshak Plus Scheme: Rakshak Plus Scheme designed by PNB offers financial protection in the form of personal accident insurance cover of 1 crore in case of death, permanent total disability and covers air accident, death at 1.5 crore Ron the lending institution said.

PNB Rakshak Plus Scheme: The state owned Punjab National Bank (PNB) last week (June 18), said it has till June 11 this year provided 17.02 crores to the families of 26 deceased defence and paramilitary personnel under its flagship Rakshak Plus Scheme.

This reinstates the stand of the bank on how it supports the courageous soldiers defending India the bank said in an official statement.

These 26 recipients included the families of such operations as Birli Gali, which offered the ultimate sacrifice to serve the nation.

The scheme, which is referred to as Rakshak Plus Scheme by the PNB, covers the financial protection in the form of personal accident cover of 1 crore in case of death, permanent total disability and air accident cover of 1.5 crore in case of death, the lender stated.

The plan has partial disability coverage and comprehensive benefits that revolve around the demands of the people in uniform, it said.

PNB CGM (BARM) Binay Gupta stated, we must in good faith be there with the families of our martyrs. Unlike the mere budget financing by the Rakshak Plus Scheme, PNB has a lot to give the brave hearts out there; a token of our admiration and further strengthening of their great sacrifices.

According to the bank owing to its dedication to celebrate the national heroes, the lender indicated that PNB remains committed in extending the much-needed finances at the appropriate time to the late kin.

PNB: Recent updates

Punjab National Bank announced last week that it sold the full stake (21 percent) it held in India SME Asset Reconstruction Company Limited (ISARC) to another company for the amount of 34 crores.

PNB had said in a regulatory filing, in March the Reserve Bank of India (RBI) had given its go-ahead to an asset reconstruction company called a change of sponsor and equity raise by Authum Investment and Infrastructure Ltd.

The bank completed the sale of a 20.90% stake on Tuesday, it said.

The share sale involved the asset reconstruction company selling the twin 2.09 crore shares of the company at 16.29 per share to total 34.04 crore.

The bank had entered into a definitive agreement to sell its entire stake in ISARC in May.

By the end of the financial year March 31, 2025, ISARC had generated a net profit of 19.79 crore of rupees with a total income of 36.4 crore of rupees.

Before the sale of the stake, ISARC was under the sponsorship of the SIDBI, Bank of Baroda, the Punjab National Bank and Sidbi Venture Capital Ltd.

The lender stated that it was hoping to achieve a huge recovery of more than 16,000 crore in May, 2025 and is aiming at maintaining slippages of less than 1 percent in the ongoing fiscal year in order to maintain profitability, the top official of the second biggest state-owned lender in the country said.

The bank recorded a total recovery of 4 733 crore in the fourth quarter and 14 336 crore annualized in the financial year 25, whereas the overall slippage ratio was at 0.73 percent in the last financial year.

PNB Q4 FY25 Results

The PSU lender reported a 52% rise in net profit at ₹4,567 crore for March quarter FY25 (Q4 FY25).

The lender had earned a net profit of ₹3,010 crore in the year-ago period.

Throughout the quarter, the total revenue of the bank rose to 36,705 crore versus 32,361 crore in the previous year, according to a reporting filed by PNB.

The interest income increased to 31,989 crore composed to 28,113 crore in the fourth quarter of the earlier finance year.

The bank stock has recorded almost a 2 percent rise in the past 30 days and 0.7 percent in the last 6 months. Over 18 percent, during the last 12 months, the share price has been lowered.

No comments:

Post a Comment